Booth NO.: 5G-A10

HKTDC April 2025 Exhibition Summary

Booth: 5G-A10

Overall Observations

This year’s HKTDC exhibition reflected significant challenges, largely influenced by the ongoing U.S. tariff uncertainties. Our booth, 5G-A10, noted a sharp decline in foot traffic compared to pre-pandemic years. Exhibitor participation dropped by over 50%, and the event felt subdued from Day 1. While attendance slightly improved on Day 2, many buyers left early on Day 3 to attend the Canton Fair in Guangzhou. Notably, the absence of U.S. Jewish buyers—historically a key demographic—was striking, and European buyers were also scarce.

Impact of U.S. Tariffs

The tariff issue dominated discussions:

- Buyer Hesitation: Multiple U.S. procurement firms (particularly those with Shenzhen offices) asked if we had production bases in tariff-exempt regions (e.g., Southeast Asia or Mexico). Several clients admitted tariffs had frozen their orders, though they attended the show to “prepare quietly” for a potential resolution ahead of the Christmas season.

- Unclear Intentions: New contacts from Japan, South Korea, Australia, Germany, and Russia showed interest but lacked urgency. Many emphasized “wait-and-see” due to tariff unpredictability.

Exhibitor Struggles

- Reduced Orders: Fellow exhibitors reported widespread order cancellations or pauses. For example, the Bluetooth conference headset booth opposite us faced production delays, leading to client dropouts and visible frustration from their team (they left the show early on Day 3).

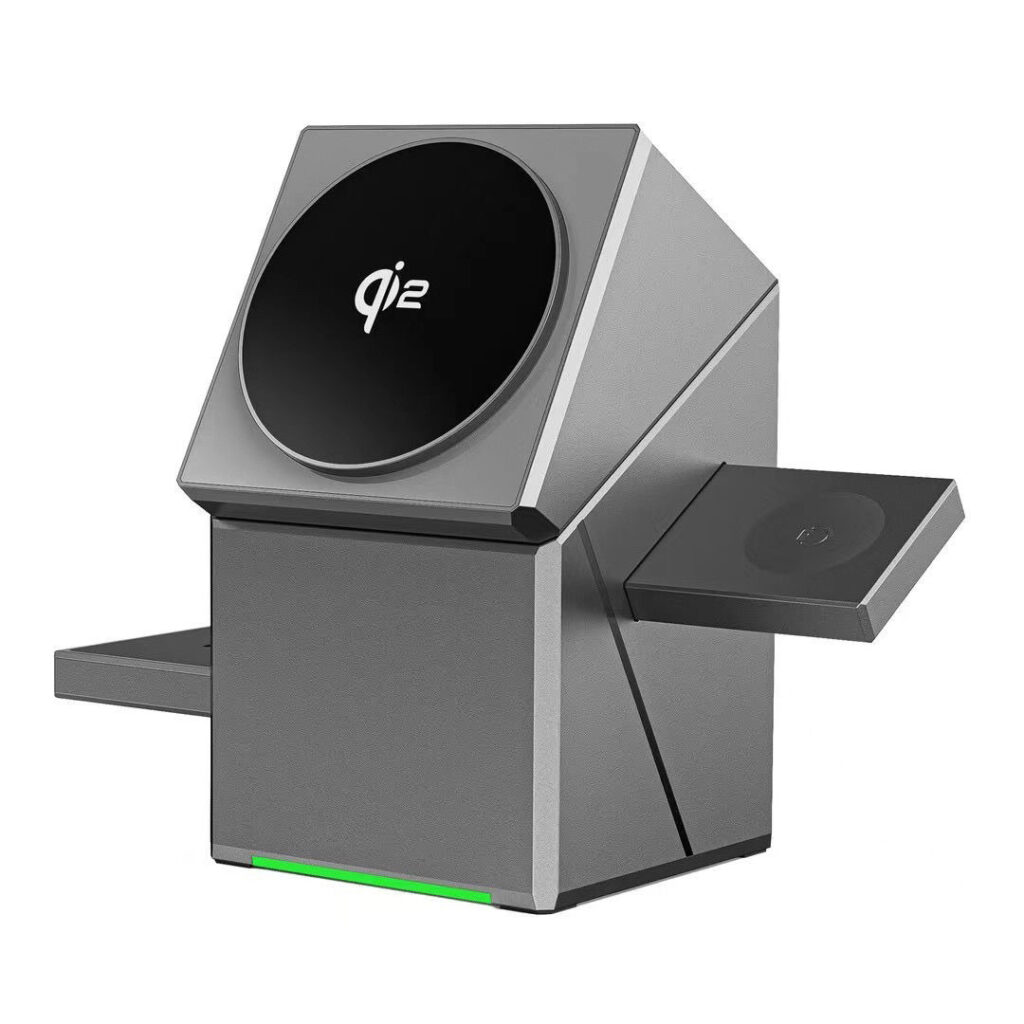

- Survival Adaptation: To offset declining Bluetooth speaker orders post-pandemic, we’ve diversified into products like electric mixing cups, wireless chargers (car/desktop), power banks, heated mugs, and small audio-light toys. While this flexibility helps retain workers, it strains our ability to specialize.

Key Takeaways

- Market Shifts: Traditional buyers (U.S./Europe) are retreating, while non-traditional markets (Colombia, Japan, Korea) offer limited but emerging opportunities.

- Tariff-Driven Relocation: Buyers increasingly prioritize suppliers with alternative production bases to bypass tariffs.

- Event Relevance: HKTDC’s declining appeal raises questions about its role amid competition from Canton Fair and regional trade shows.

Next Steps

- Supply Chain Diversification: Explore partnerships or facilities in tariff-exempt regions to meet buyer demands.

- Product Focus: Balance diversification with R&D investments in high-potential categories (e.g., smart home gadgets).

- Client Retention: Maintain close communication with existing contacts awaiting tariff clarity.

- Regional Targeting: Strengthen outreach to RCEP markets (e.g., Australia, Japan) while cautiously engaging Russian buyers amid geopolitical risks.

Conclusion

While the exhibition underscored current global trade uncertainties, it also highlighted resilience strategies: adaptability, geographic flexibility, and client loyalty. We’ll continue balancing survival tactics with long-term planning, hoping for clearer trade policies to revive confidence.

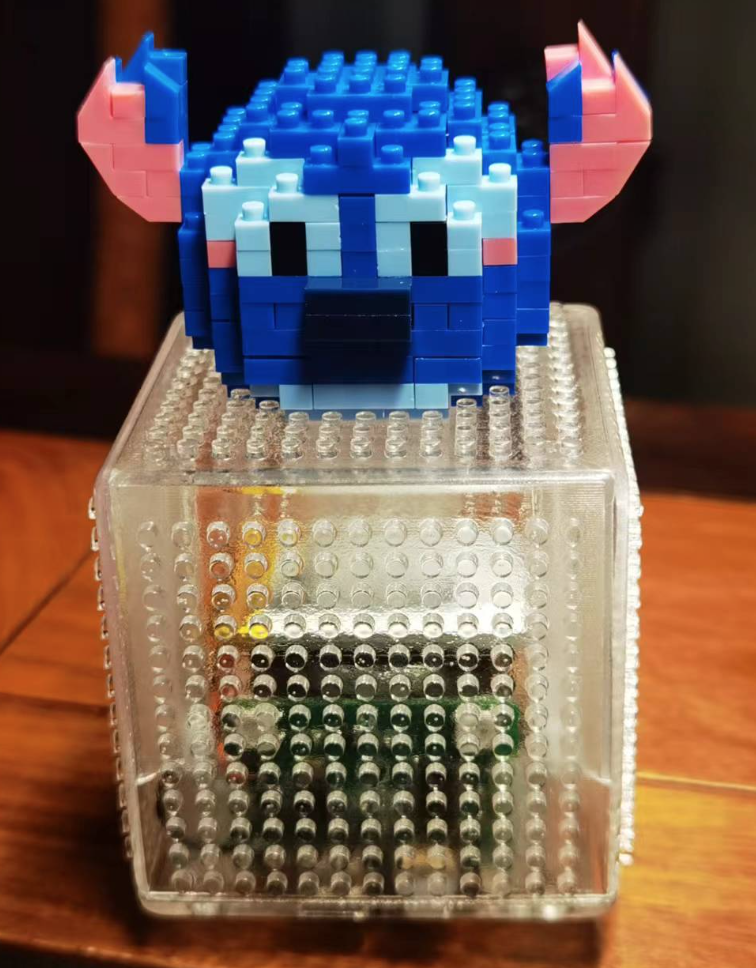

Below pictures and vlog of the show, FYI: